Request a call back

Ready to take the next step? Request a call back from our expert team today and let us guide you towards solutions tailored to your needs. Fill out the quick form with your details, choose a convenient time, and we’ll be in touch.

Pension Salary Sacrifice

What is a salary sacrifice?

A salary sacrifice means that employees give up part of their salary, which would normally be subject to income tax and national insurance contributions, in return for a non-cash benefit free of tax or NI. Participation is entirely voluntary, but it’s important to remember that it does change the terms and conditions of employment.

How can a salary sacrifice increase pension contributions?

A contractual gross salary is reduced by an agreed-upon percentage or fixed amount, which is then contributed to a pension instead, along with a normal employer contribution.

For instance, a 5% sacrifice will make the total contribution to the pension 8% total, with the remaining 3% covered by the employer.

What are the main benefits?

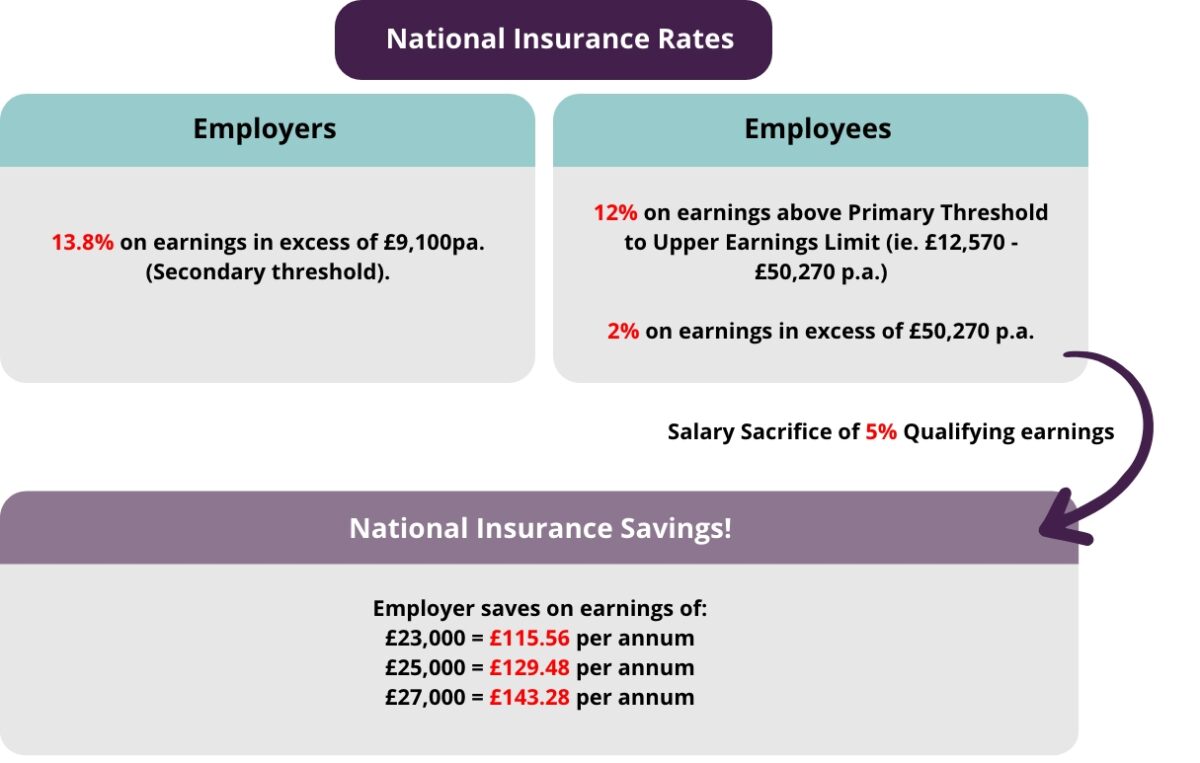

The main benefit from a salary sacrifice are the savings you and your employees can make in national insurance contributions. If a gross salary is reduced, then the amount spent on national insurance (from both employer and employee) decreases accordingly.

For example, on a £10,000 pension contribution made through salary sacrifice, an employee would pay £200 in national insurance as opposed to the usual £300.

Another benefit is that employees can potentially save on income tax. By sacrificing part of their salary towards their pension, they are reducing their taxable income and therefore paying less income tax overall.

Are there any drawbacks?

One drawback is that salary sacrifice may reduce an employee’s entitlement to certain state benefits, such as statutory maternity pay or maternity allowance. You also cannot use a salary sacrifice if the deduction takes the employee below minimum wage.

Additionally, employees who are enrolled in a salary sacrifice scheme may see a reduction in their take-home pay, which could potentially affect their personal finances and budgeting.

What other non-cash benefits can be offered through salary sacrifice?

Aside from pension contributions, other common non-cash benefits that can be offered through salary sacrifice include childcare vouchers, cycle to work schemes, health and dental insurance and a whole host of other benefits and incentives.

Ultimately, salary sacrifice can be an extremely useful tool for both employers and employees to increase pension contributions and save on taxes. However, it’s always important to carefully examine the particulars to see if it’s the right thing for you and your business. If properly managed and communicated, it can be a win-win for both parties, so it’s well worth considering as part of an employee benefits package.

To find out more, or to discuss how implementing a salary sacrifice scheme could help with your business, why not get in touch with our dedicated team of payroll experts on 01455 444 222 or email [email protected] to get started today!

HR:4UK is game-changing HR solutions for you, without delay.

experience

HR support services specialising in employment law for businesses and their people